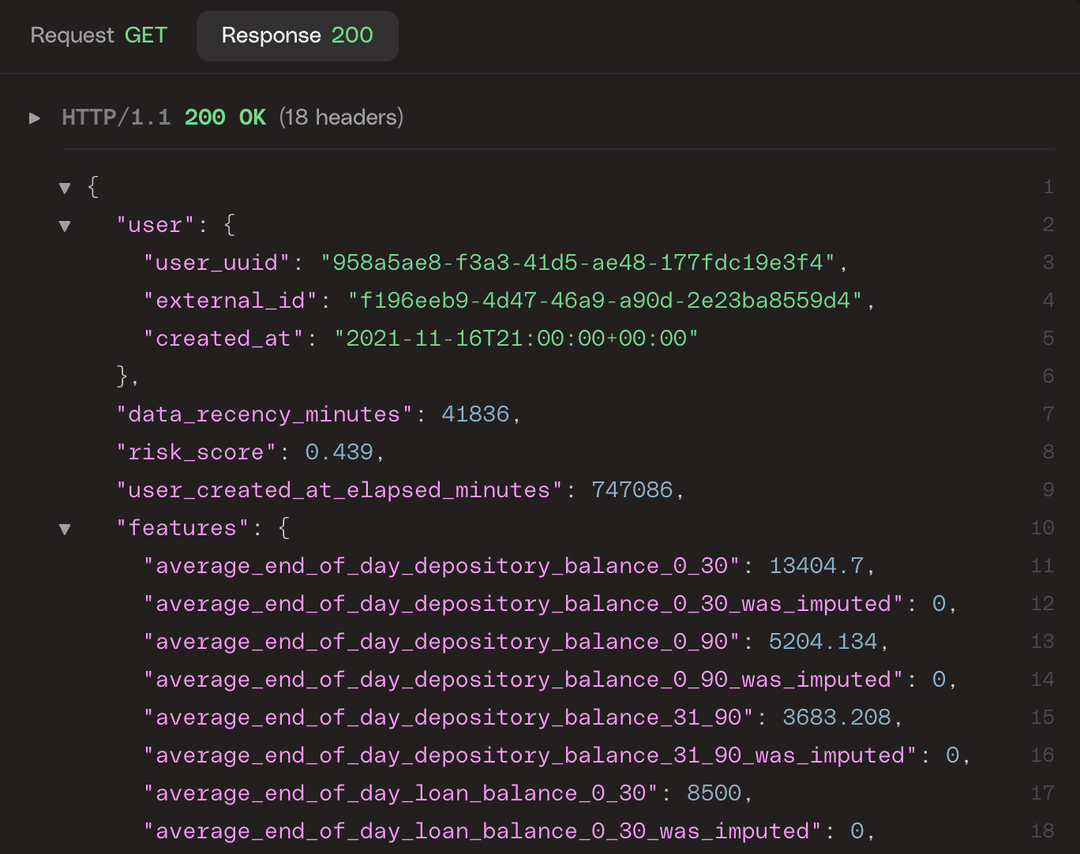

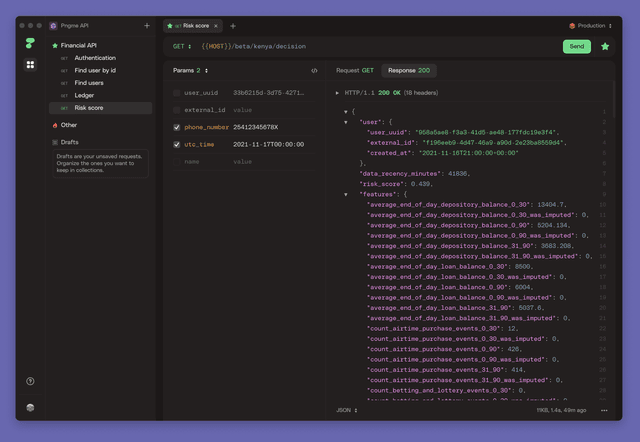

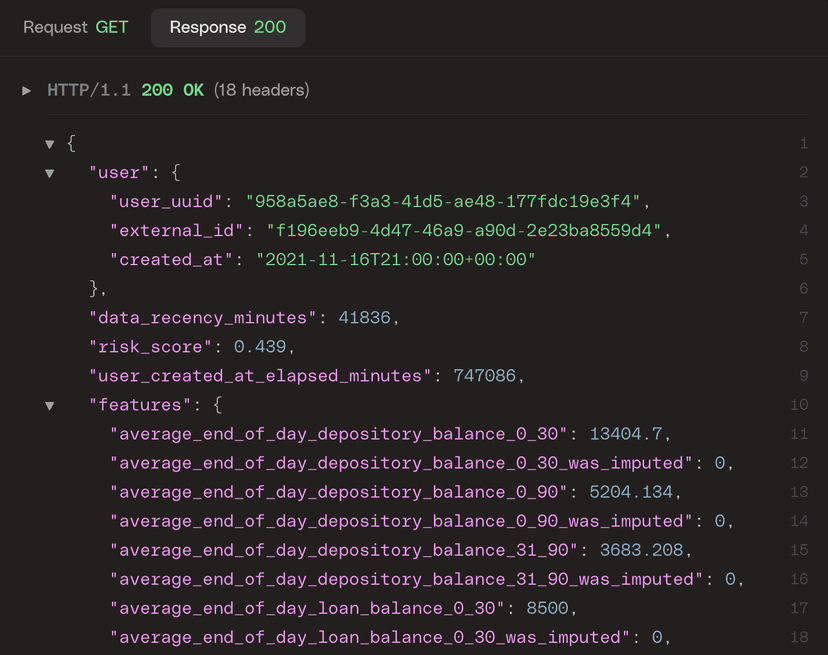

Automated Feature Building

Generate 500+ predictive features tailored to enhance data-driven decision-making and financial intelligence. Streamline feature engineering and model development for your specific use cases.

Core Features

Our feature engineering platform accelerates your machine learning development

Automated Features Development

Quickly generate ML models-ready features customized for industry-specific challenges, reducing manual effort and development time.

- Rapid feature generation

- Industry-specific templates

- Automated feature selection

Use Cases

Discover how Automated Feature Building can transform your business

Customer Segmentation

Improve marketing and engagement strategies by classifying customers based on lifestyle and financial behavior.

Credit Risk Assessment

Automate risk profiling for underbanked segments, such as motorcycle taxi operators, using predictive financial behaviors.

Personalized Financial Products

Enhance lending strategies by incorporating dynamic user attributes into credit and loan offerings.

Alternative Lending & BNPL

Support lending models for gig workers, motorcycle taxis, and underbanked populations.

500+ Predictive Features

Our comprehensive library of predictive features helps you gain deeper insights into customer behavior and financial patterns.

dynamic_income_score

Predicts income stability based on transaction patterns

lifestyle_affinity_index

Measures customer lifestyle preferences and spending habits

credit_behavior_pattern

Analyzes repayment behavior and credit utilization