LoanIQ Engine

Intelligent loan processing platform that optimizes the entire lending lifecycle from application to servicing. Automate decisions, reduce processing time, and enhance loan portfolio performance.

Core Features

Our intelligent loan processing platform streamlines your entire lending operation

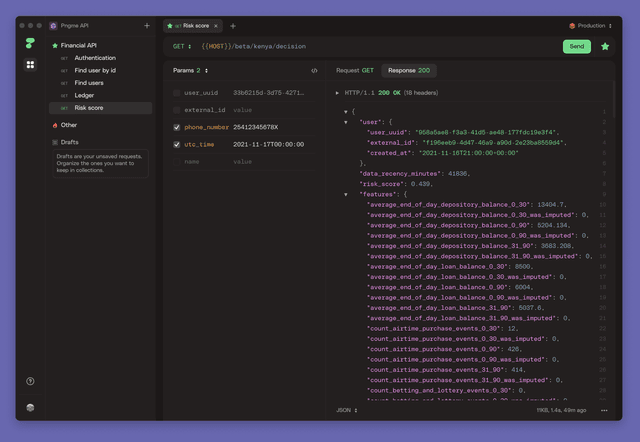

Intelligent Decision Engine

AI-powered decision making that automatically approves or flags loan applications based on comprehensive risk assessment.

- Automated decisioning

- Rule-based workflows

- Configurable approval criteria

Loan Processing Workflow

Our streamlined process transforms traditional lending operations

Application

Digital application intake with automated data collection and verification.

Assessment

AI-powered risk assessment and credit scoring with multi-factor evaluation.

Decision

Automated approval with customized loan terms based on risk profile.

Servicing

Ongoing loan management with payment tracking and intervention strategies.

Mobile-First Lending

Our platform is designed for the mobile-first consumer, allowing borrowers to apply, track, and manage their loans from anywhere.

Seamless mobile experience

Apply for loans and track status from any mobile device

Quick decisions

Get loan approvals in minutes, not days

Proven Impact

Our clients have achieved remarkable results with LoanIQ Engine

Reduction in Processing Time

Increase in Approval Rate

Improvement in Collection Rates

Reduction in Operational Costs