Liability Master

Liability Master is an AI-powered liability optimization engine designed to help banks and fintechs maximize deposit growth, increase card adoption, and automate cross-selling. By leveraging real-time data and advanced machine learning algorithms, Liability Master targets unfunded customer accounts—such as savings, fixed deposits, money market funds, and checking accounts—to generate tailored financial solutions that promote both customer engagement and revenue generation.

Core Features

Our AI-powered liability optimization engine delivers powerful capabilities for your financial institution

Dynamic Pricing Engine

This feature continuously analyzes a bank's liquidity needs and market conditions to set optimized deposit interest rates. It ensures that the bank operates at the lowest possible cost while still attracting deposits.

- Market interest rates comparison module

- Interest rate recommender based on dynamic pricing engine

- Interactive dashboard with current optimized rates and projections

Use Cases

Discover how Liability Master can transform your financial institution's approach to liability management

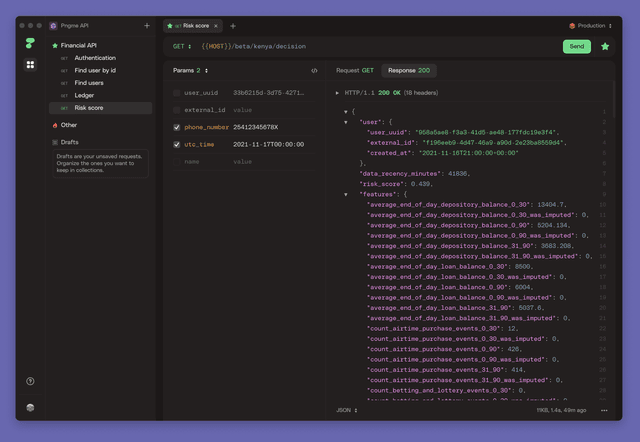

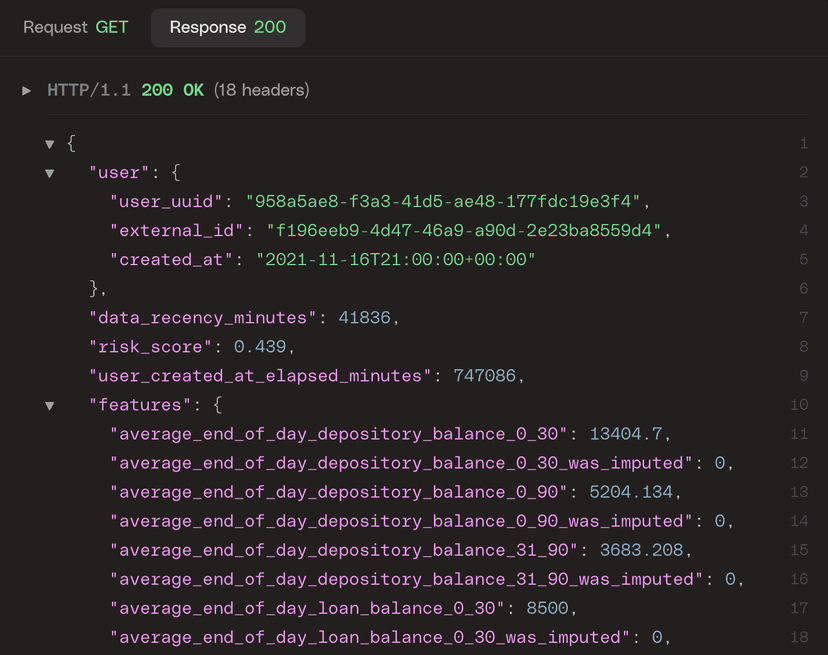

Credit Scoring & Loan Approvals

Leverage dynamic, data-driven risk models to improve credit scoring and streamline loan approval processes. The system uses historical data and real-time financial behavior to assess risk more accurately, thus improving decision-making.

Deposit Rate Optimization

Adjust interest rates dynamically to maintain optimal liquidity levels while remaining competitive. The feature provides continuous adjustments that help attract and retain depositors.

Credit & Debit Card Growth

Drive higher card activations and spending by offering personalized, AI-curated card products. The engine determines the best offers to increase customer engagement and boost card usage.

Automated Loan & Product Upselling

The product proactively identifies customers who might benefit from additional financial products—such as loans, credit cards, or savings plans, by analyzing their financial habits and transaction trends.

Customer Retention & Engagement

Improve customer loyalty by providing context-aware financial recommendations that keep users engaged. The product recommends offering tailored messaging based on the customer's life cycle stage and recent interactions.

Proven Results

Clients who have adopted Liability Master have achieved significant improvements in their liability management initiatives

Increase in Card Activations

Increase in Deposit Growth Across Targeted Customer Segments

increase in additional product take-up

reduction in Customer Churn