Risk 360

Comprehensive risk assessment platform that combines traditional and alternative data to provide a holistic view of credit risk. Make better lending decisions with deeper insights into customer financial behavior.

Complete Risk Assessment

Our Risk 360 platform provides a comprehensive view of credit risk by analyzing both traditional and alternative data sources.

Multi-dimensional scoring

Evaluate risk across multiple dimensions for a complete picture

Early warning detection

Identify potential issues before they impact repayment

Core Features

Our comprehensive risk assessment tools provide a complete view of your customers

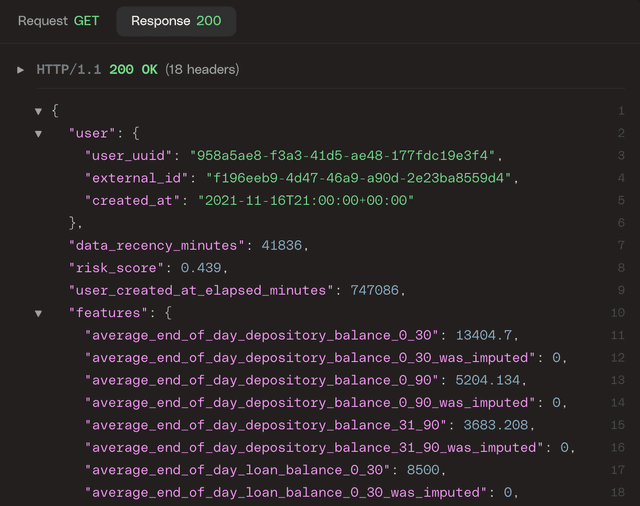

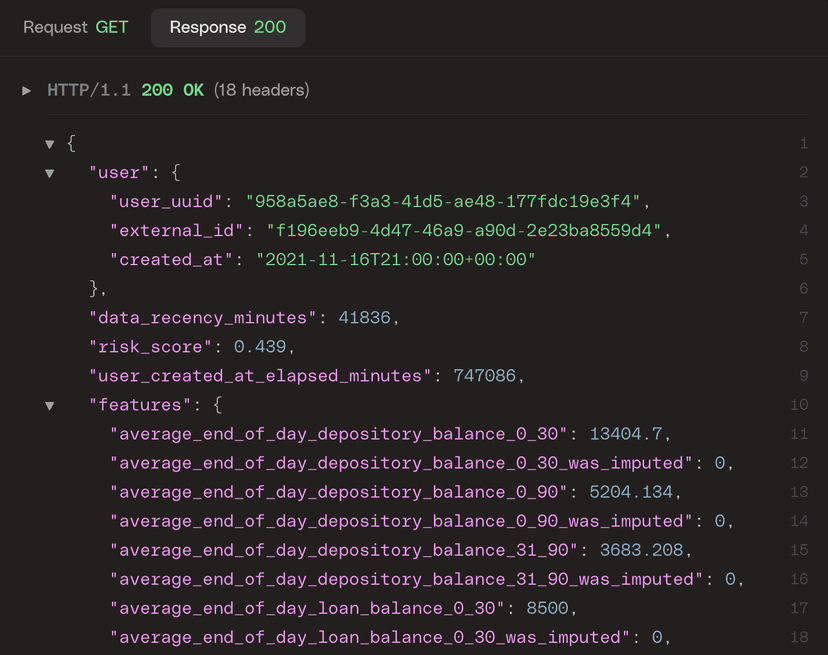

Multi-Factor Risk Analysis

Evaluate credit risk using multiple data points including transaction history, behavioral patterns, and traditional credit scores.

- Comprehensive risk profiling

- Multi-dimensional scoring

- Integrated data sources

Use Cases

Discover how Risk 360 can transform your risk assessment processes

Enhanced Credit Decisioning

Improve loan approval rates while maintaining or reducing default rates by leveraging comprehensive risk assessment.

Emerging Market Lending

Extend financial services to underserved populations with limited credit history through alternative data assessment.

Risk-Based Pricing

Implement dynamic, personalized pricing strategies based on individual risk profiles and financial behavior.

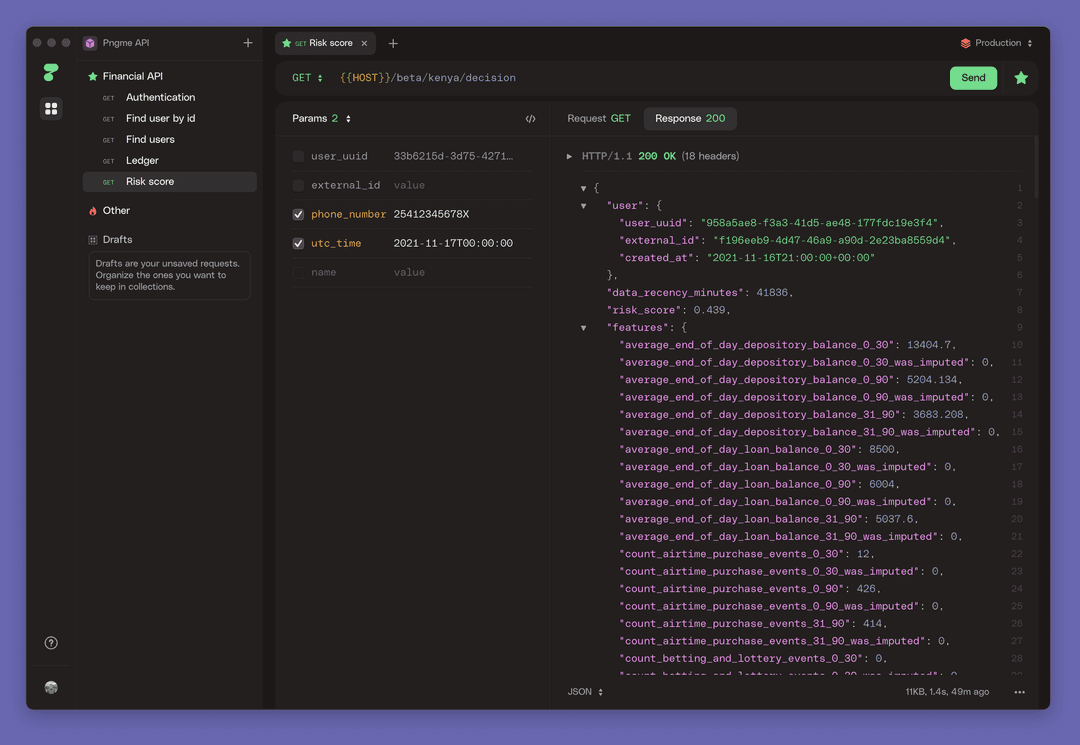

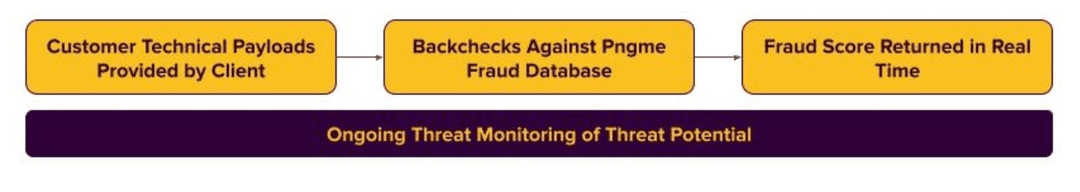

Advanced Fraud Detection

Our platform uses sophisticated algorithms to identify suspicious patterns and potential fraud attempts before they impact your business.

Real-time alerts

Get notified immediately when suspicious activity is detected

Proven Results

Our clients have seen significant improvements in their risk assessment metrics

Reduction in Default Rates

Increase in Approval Rates

Better Risk Differentiation

ROI for Financial Institutions